Employee group health benefits are an essential part of a comprehensive compensation package, offering employees peace of mind and financial security. They encompass a wide range of coverage options, from health insurance and dental care to life insurance and disability protection, providing a safety net for employees and their families. Understanding the different types of benefits available, their cost implications, and the legal framework surrounding them is crucial for both employers and employees alike.

This guide explores the multifaceted world of employee group health benefits, providing insights into the key factors that influence their design, the cost considerations involved, and the emerging trends shaping the industry. We delve into the importance of effective communication and education to ensure employees fully understand their benefits and how to maximize their value.

Types of Employee Group Health Benefits

Employee group health benefits are a valuable part of a comprehensive compensation package, offering employees financial protection and peace of mind. These benefits help cover the costs of healthcare, dental care, vision care, and other essential services, contributing to employee well-being and overall productivity.

Health Insurance

Health insurance is a crucial component of employee group health benefits, providing financial protection against high healthcare costs. It covers a wide range of medical expenses, including doctor visits, hospital stays, surgeries, and prescription drugs.

- Health Maintenance Organizations (HMOs): HMOs typically have lower premiums than other plans but offer limited provider choices. They require members to choose a primary care physician (PCP) who acts as a gatekeeper for referrals to specialists. HMOs emphasize preventive care and cost-effective treatment options.

- Preferred Provider Organizations (PPOs): PPOs provide greater flexibility in choosing healthcare providers, including both in-network and out-of-network options. They offer higher premiums than HMOs but generally have lower out-of-pocket costs for in-network services.

- Point-of-Service (POS) Plans: POS plans combine elements of HMOs and PPOs, offering flexibility in provider selection while still emphasizing preventive care. They require a PCP referral for specialist visits but allow out-of-network access at a higher cost.

Dental Insurance

Dental insurance helps cover the costs of preventive, diagnostic, and restorative dental care, promoting oral health and preventing costly dental problems. It typically includes coverage for routine cleanings, fillings, extractions, and other dental procedures.

Vision Insurance

Vision insurance helps cover the costs of eye exams, eyeglasses, and contact lenses. It promotes eye health by providing access to routine eye care and helps employees manage vision-related expenses.

Life Insurance

Life insurance provides financial security to beneficiaries in the event of an employee’s death. It offers a lump-sum payment that can help cover funeral expenses, outstanding debts, and provide financial support for surviving dependents.

Disability Insurance

Disability insurance provides income replacement in case of an employee’s inability to work due to illness or injury. It helps protect employees’ financial stability during periods of temporary or permanent disability.

Flexible Spending Accounts (FSAs)

FSAs allow employees to set aside pre-tax income for eligible healthcare and dependent care expenses. This reduces an employee’s taxable income and lowers overall healthcare costs.

Importance of Employee Group Health Benefits

Employee group health benefits are an essential part of a comprehensive compensation package that significantly contributes to employee well-being and job satisfaction. These benefits not only provide financial protection against unexpected medical expenses but also demonstrate an employer’s commitment to the health and well-being of their workforce.

Impact on Employee Well-being and Job Satisfaction

Offering employee group health benefits has a direct impact on employee well-being and job satisfaction. When employees feel secure about their health and financial well-being, they are more likely to be happy, engaged, and productive. Studies have shown a strong correlation between employee health benefits and improved employee morale, reduced stress levels, and increased job satisfaction.

- Reduced Stress and Anxiety: Employees with access to comprehensive health benefits experience reduced stress and anxiety related to potential medical expenses, allowing them to focus on their work and personal lives.

- Improved Mental Health: Many health plans offer mental health services, which can be particularly valuable in today’s world, addressing issues like anxiety, depression, and burnout, which can significantly impact job performance.

- Enhanced Physical Health: Access to preventive care, regular checkups, and health screenings through group health benefits can help employees identify and manage health issues early, improving their overall physical health and well-being.

- Increased Job Satisfaction: Employees who feel valued and cared for by their employers are more likely to be satisfied with their jobs. Offering comprehensive health benefits demonstrates this commitment, contributing to higher job satisfaction and loyalty.

Impact on Employee Productivity and Retention, Employee group health benefits

Employee group health benefits play a crucial role in boosting employee productivity and reducing turnover. When employees are healthy and feel supported by their employers, they are more likely to be engaged, motivated, and productive.

- Reduced Absenteeism: Employees with access to preventive care and early treatment options are less likely to experience health issues that lead to absenteeism. This results in improved workforce continuity and productivity.

- Increased Engagement and Motivation: Employees who feel valued and cared for by their employers are more likely to be engaged and motivated in their work.

- Reduced Turnover: Employees who feel supported by their employers through comprehensive health benefits are less likely to seek employment elsewhere, leading to lower turnover rates and a more stable workforce.

Impact on Company Performance

The impact of employee group health benefits extends beyond individual employees to the overall performance of the company.

- Improved Financial Performance: Reduced absenteeism, increased productivity, and lower turnover rates directly contribute to improved financial performance by reducing operational costs and increasing profitability.

- Enhanced Reputation and Brand Image: Companies that prioritize employee well-being and offer comprehensive health benefits are often perceived as more responsible and attractive employers, enhancing their reputation and brand image.

- Stronger Competitive Advantage: In a competitive job market, offering attractive employee benefits, including comprehensive health coverage, can give companies a significant advantage in attracting and retaining top talent.

Role in Attracting and Retaining Top Talent

In today’s competitive job market, offering competitive employee benefits, including comprehensive health coverage, is crucial for attracting and retaining top talent.

- Enhanced Employer Brand: Companies that offer comprehensive health benefits are seen as more desirable employers, attracting top talent who value their well-being and seek a supportive work environment.

- Improved Employee Retention: Employees who feel valued and supported by their employers are more likely to remain with the company, reducing turnover costs and ensuring a stable workforce.

- Access to a Wider Talent Pool: Offering competitive health benefits can attract a wider range of candidates, including those with families or specific health needs, expanding the pool of potential talent.

Factors Influencing Group Health Benefit Design: Employee Group Health Benefits

Designing a comprehensive and effective group health benefits package is a crucial aspect of employee compensation and benefits strategies. Companies consider various factors to ensure their plans are attractive to employees, meet their needs, and remain financially sustainable.

Industry and Company Size

The industry and company size play a significant role in shaping group health benefits. Different industries have varying risk profiles and health care costs. For instance, construction and manufacturing industries may have higher risks of work-related injuries, while healthcare and technology industries may have different health concerns. Similarly, larger companies have more resources and bargaining power to negotiate favorable rates with insurance providers.

- Industry-Specific Needs: Companies tailor their benefits to address specific health needs within their industry. For example, a construction company may offer enhanced coverage for work-related injuries and disabilities, while a technology company might focus on mental health and wellness programs.

- Size and Scale: Larger companies often offer a wider range of benefits and may have access to self-funded health insurance plans, which can provide greater flexibility and cost control.

Employee Demographics

Employee demographics, such as age, gender, and family status, significantly influence the design of group health benefits. Younger employees may have different health needs and preferences than older employees, while employees with families require comprehensive coverage for dependents.

- Age and Health Status: The health needs of employees vary with age. Younger employees may have fewer health concerns, while older employees may require coverage for chronic conditions and preventive care.

- Family Status: Companies often offer dependent coverage for spouses and children. The number of dependents and their health needs influence the overall cost and design of the plan.

Cost-Containment Strategies

Cost-containment strategies are essential for managing the rising costs of health care. Companies implement various strategies to control expenses while providing adequate coverage to their employees.

- High-Deductible Health Plans (HDHPs): HDHPs have lower premiums but higher deductibles, encouraging employees to be more cost-conscious in their healthcare decisions.

- Health Savings Accounts (HSAs): HSAs allow employees to contribute pre-tax dollars to a health savings account, which can be used for eligible medical expenses. These accounts offer tax advantages and promote personal responsibility for health care costs.

- Wellness Programs: Companies offer wellness programs to promote healthy lifestyles and reduce health risks. These programs can include fitness incentives, health screenings, and disease management programs.

Health Care Reform

Health care reform legislation, such as the Affordable Care Act (ACA) in the United States, has significantly impacted group health benefits. These reforms have introduced new regulations, mandates, and subsidies that companies must comply with.

- Essential Health Benefits: The ACA requires health insurance plans to cover essential health benefits, including preventive care, hospitalization, and prescription drugs.

- Individual Mandate: The ACA required most individuals to have health insurance or face a penalty. This mandate aimed to expand health insurance coverage and reduce the number of uninsured individuals.

- Subsidies: The ACA provides subsidies to help low- and middle-income individuals afford health insurance. These subsidies are available through the health insurance marketplaces.

Cost Considerations for Group Health Benefits

Choosing and managing employee group health benefits involves careful consideration of various cost factors. These costs are shared between employers and employees, and understanding these cost-sharing models is crucial for both parties.

Cost-Sharing Models for Group Health Benefits

Cost-sharing models aim to balance the costs of healthcare between employers and employees. Common cost-sharing models include:

- Premiums: Monthly payments made by employers and/or employees to maintain health insurance coverage. The employer’s contribution is typically a fixed amount, while the employee’s contribution may vary based on factors such as plan selection and dependents.

- Deductibles: The amount an employee must pay out-of-pocket before the insurance plan starts covering healthcare costs. Deductibles can be annual or per service, and higher deductibles often correspond to lower premiums.

- Co-pays: Fixed amounts employees pay for specific healthcare services, such as doctor’s visits or prescription drugs. Co-pays are typically lower than deductibles and help manage the cost of routine care.

- Co-insurance: A percentage of healthcare costs that the employee pays after meeting the deductible. For example, an 80/20 co-insurance model means the insurance plan covers 80% of the costs, and the employee pays the remaining 20%.

Comparing Costs of Health Insurance Plans

Different health insurance plans offer varying levels of coverage and cost structures. Some key factors to consider when comparing plans include:

- Network Size: Larger networks provide access to a wider range of healthcare providers, but may have higher premiums. Smaller networks may offer lower premiums but restrict provider choices.

- Coverage Levels: Plans vary in the services they cover, such as preventive care, prescription drugs, and mental health services. Higher coverage levels generally correspond to higher premiums.

- Employee Contributions: Employee contributions to premiums, deductibles, and co-pays can significantly impact the overall cost of health insurance. Plans with lower employee contributions may have higher premiums, and vice versa.

Impact of Rising Healthcare Costs

Rising healthcare costs have a significant impact on group health benefit premiums and employer contributions. Factors contributing to rising healthcare costs include:

- Technological Advancements: New medical technologies and treatments can be expensive, increasing the overall cost of healthcare.

- Aging Population: As the population ages, the demand for healthcare services increases, leading to higher costs.

- Chronic Diseases: The prevalence of chronic diseases, such as diabetes and heart disease, drives up healthcare expenditures.

- Administrative Costs: The complex administrative processes associated with healthcare insurance add to the overall cost.

Strategies for Managing Healthcare Costs

Employers are actively seeking strategies to manage rising healthcare costs and maintain affordable group health benefits. Some common approaches include:

- Wellness Programs: Encouraging employee health and well-being through programs such as fitness initiatives and health screenings can help prevent chronic diseases and reduce healthcare costs.

- Value-Based Care: Shifting from fee-for-service models to value-based care models, which incentivize quality care and better health outcomes, can help control costs.

- Transparency and Consumerism: Providing employees with tools and information to compare healthcare costs and make informed decisions about their care can promote cost-consciousness.

Trends in Employee Group Health Benefits

The landscape of employee group health benefits is constantly evolving, driven by factors such as rising healthcare costs, technological advancements, and changing employee preferences. Understanding these trends is crucial for employers to design and implement effective benefits packages that meet the needs of their workforce.

High-Deductible Health Plans (HDHPs) and Health Savings Accounts (HSAs)

HDHPs are health insurance plans with high deductibles, which are the amount you pay out-of-pocket before your insurance kicks in. HSAs are tax-advantaged savings accounts that can be used to pay for healthcare expenses. The combination of HDHPs and HSAs has become increasingly popular in recent years, offering employers a way to control costs while providing employees with more flexibility and control over their healthcare spending.

Telehealth Services

Telehealth services, which allow individuals to consult with healthcare providers remotely through video conferencing or phone calls, have gained significant traction. This trend is fueled by the convenience and affordability of telehealth, as well as the growing demand for accessible healthcare options. Telehealth can be used for a wide range of services, including primary care, mental health counseling, and prescription refills.

Innovative Healthcare Delivery Models

The healthcare industry is exploring innovative delivery models to improve quality and efficiency. These models include:

- Value-based care: This model focuses on providing high-quality care while managing costs. Providers are rewarded for achieving positive health outcomes for their patients.

- Direct primary care: This model offers patients a subscription-based service that provides access to primary care physicians without the need for insurance.

- Concierge medicine: This model provides patients with personalized and comprehensive care, often with a higher price tag.

Employee Preferences and Changing Demographics

Employee preferences are also shaping the design of group health benefits. For example, younger employees are more likely to value telehealth services and mental health benefits, while older employees may prioritize coverage for chronic conditions. Employers are increasingly tailoring their benefits packages to meet the diverse needs of their workforce.

“By 2025, the number of Americans aged 65 and older is projected to reach 73.1 million, representing 22.2% of the population.”U.S. Census Bureau

Legal and Regulatory Considerations

Navigating the complex landscape of employee group health benefits requires a thorough understanding of the legal and regulatory framework governing these plans. Employers must comply with a multitude of federal and state laws, ensuring their plans meet all requirements to avoid penalties and potential legal issues.

Affordable Care Act (ACA)

The Affordable Care Act (ACA) has significantly impacted employee group health benefits, introducing new regulations and requirements for employers. Understanding the ACA’s provisions is crucial for employers to ensure their plans are compliant.

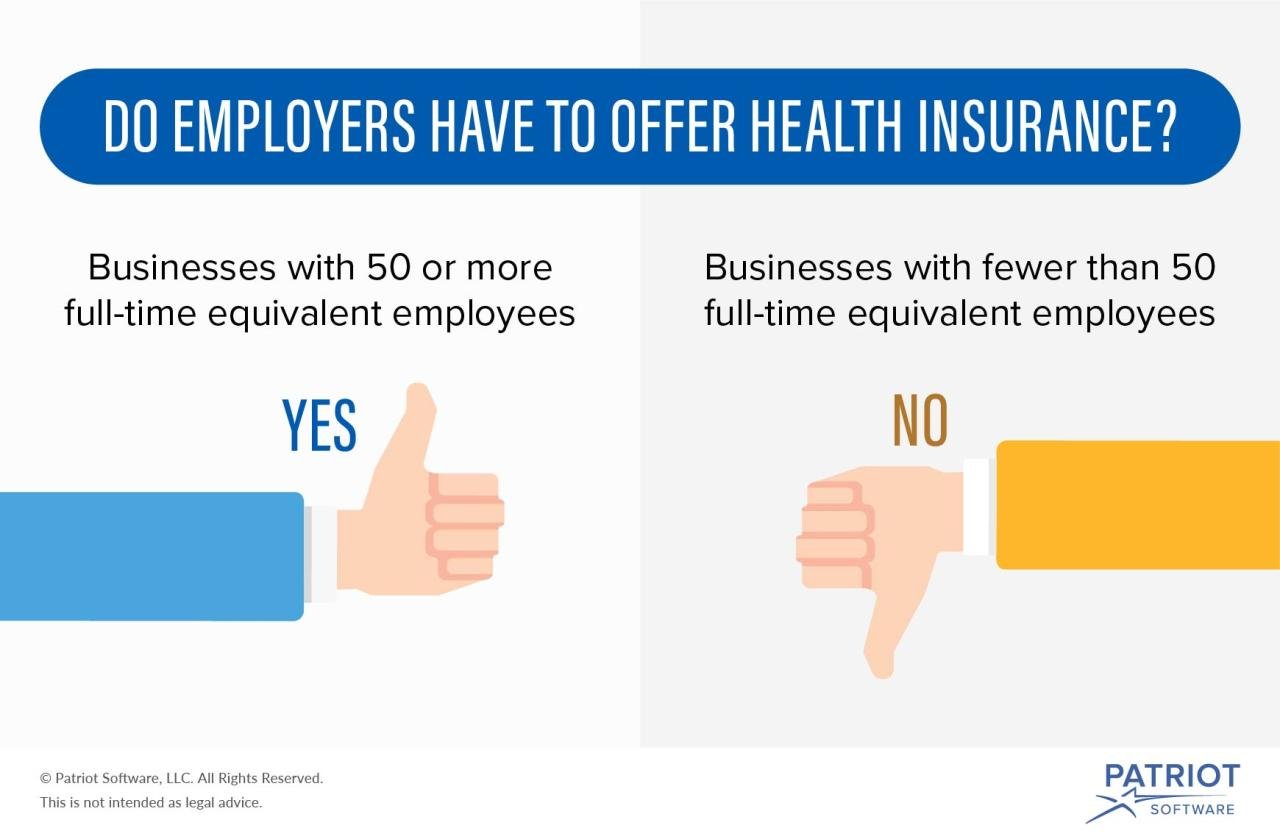

- Employer Mandate: Employers with 50 or more full-time equivalent employees are required to offer health insurance to their employees or face penalties. This mandate applies to employers who have at least one employee working 30 hours or more per week.

- Essential Health Benefits: The ACA mandates that all health insurance plans, including employer-sponsored plans, must cover ten essential health benefits. These benefits include preventive care, hospitalization, maternity care, mental health services, and prescription drugs.

- Individual Mandate: The ACA also requires most individuals to have health insurance or face a penalty. While this mandate has been suspended, it’s important to note that employers must provide information to their employees about the ACA’s individual mandate.

- Premium Tax Credits: The ACA provides premium tax credits to eligible individuals to help them afford health insurance. Employers must provide employees with information about these tax credits.

State Regulations

In addition to federal regulations, states also have their own laws governing employee group health benefits. These state regulations can vary significantly, and employers must be aware of the laws in the states where they operate.

- State-Specific Mandates: Some states have their own mandates that go beyond the ACA’s requirements. For example, some states require employers to cover specific benefits, such as infertility treatment or long-term care.

- Consumer Protection Laws: States have laws protecting consumers from unfair or deceptive practices in the health insurance market. Employers must ensure that their plans comply with these laws.

- Data Privacy and Security: States have laws governing the collection, use, and disclosure of personal health information. Employers must comply with these laws when administering their employee group health benefits plans.

Implications of Compliance

Compliance with health benefits laws has significant implications for employers and employees.

- Employee Benefits: Compliance ensures that employees receive the benefits they are entitled to under the law. This includes access to essential health benefits, protection from unfair practices, and the ability to obtain affordable health insurance.

- Employer Costs: Non-compliance can result in significant financial penalties for employers. The ACA’s employer mandate carries penalties for employers who fail to offer health insurance to their employees. Additionally, state regulations can impose penalties for non-compliance.

- Legal Liability: Employers can be held liable for violations of health benefits laws. This can include lawsuits from employees, fines from regulatory agencies, and reputational damage.

Penalties for Non-Compliance

Non-compliance with health benefits laws can result in significant penalties for employers.

- ACA Employer Mandate Penalties: Employers who fail to offer health insurance to their employees as required by the ACA can face penalties of up to $2,700 per employee per year.

- State Penalties: State regulations can also impose penalties for non-compliance, which can vary depending on the state and the nature of the violation.

- Legal Costs: Employers who face lawsuits or regulatory investigations due to non-compliance can incur significant legal costs.

Employee Communication and Education

Effective communication is essential for ensuring employees understand and utilize their group health benefits. A well-designed communication strategy helps employees make informed decisions about their health coverage, leading to increased satisfaction and utilization of benefits.

Communication Strategy Design

A comprehensive communication strategy involves various channels and methods to reach all employees effectively.

- Initial Enrollment Period: During the initial enrollment period, provide clear and concise information about the available plans, coverage options, and enrollment process. Use multiple communication channels, such as email, intranet, printed materials, and presentations, to reach all employees.

- Ongoing Communication: After the initial enrollment, maintain regular communication to keep employees informed about changes in benefits, new resources, and important dates. Use newsletters, email updates, and internal communication platforms to disseminate information.

- Targeted Communication: Tailor communication based on employee demographics, job roles, and benefit needs. For example, new hires might require more detailed information about enrollment processes, while experienced employees might benefit from information on specific health conditions or wellness programs.

- Open Communication Channels: Encourage open communication by providing multiple avenues for employees to ask questions and seek clarification. Offer dedicated email addresses, phone lines, or online forums for employee inquiries.

Educational Materials Development

Educational materials should be accessible, engaging, and tailored to different learning styles.

- Benefit Summary: Provide a concise and easy-to-understand summary of each benefit plan, including key features, coverage details, and cost information. This document should be readily available on the company intranet or in printed format.

- Plan Comparison Tool: Offer an interactive tool that allows employees to compare different plan options side-by-side, considering factors like premiums, deductibles, co-pays, and coverage levels. This helps employees make informed decisions based on their individual needs and preferences.

- Benefit Guides: Create comprehensive guides that explain different types of benefits, coverage options, and enrollment processes in detail. These guides can be structured as FAQs, step-by-step instructions, or visual infographics.

- Interactive Tutorials: Develop online tutorials or videos that explain complex concepts in a clear and engaging manner. This format can be particularly effective for younger employees who prefer visual learning.

Employee Support and Resources

Providing ongoing support and resources helps employees navigate their health benefits effectively.

- Dedicated Benefit Representatives: Employ dedicated benefit representatives who can answer employee questions, resolve issues, and provide personalized guidance. These representatives can be available through phone, email, or in-person appointments.

- Online Resources: Offer a comprehensive online resource center with information about benefits, claims procedures, provider directories, and wellness programs. This platform should be easily accessible and user-friendly.

- Employee Assistance Programs (EAPs): Provide access to EAPs that offer confidential counseling and support for a wide range of personal and work-related issues. EAPs can help employees manage stress, improve mental health, and address work-life balance concerns.

- Wellness Programs: Implement wellness programs that encourage healthy lifestyles, preventive care, and early detection of health issues. These programs can include fitness activities, health screenings, and educational workshops.

Array

Effectively managing employee group health benefits is crucial for attracting and retaining top talent, fostering a healthy workforce, and controlling costs. Implementing best practices ensures that your company offers a comprehensive and competitive benefits package that meets the needs of your employees while remaining financially sustainable.

Regular Benefit Reviews and Adjustments

Regularly reviewing and adjusting your group health benefits plan is essential for maintaining its relevance and effectiveness. This involves assessing factors such as employee demographics, healthcare trends, and budget constraints.

- Conduct annual reviews: Evaluate your current plan’s performance, including utilization rates, cost trends, and employee satisfaction. Consider conducting employee surveys to gather feedback on their needs and preferences.

- Stay informed about healthcare trends: Keep abreast of changes in healthcare legislation, technology, and emerging health concerns. This will help you make informed decisions about benefit offerings.

- Consider market benchmarks: Compare your plan’s benefits and costs to those offered by similar companies in your industry. This helps ensure your plan remains competitive and attractive to employees.

- Adjust benefits based on data: Use data gathered from your reviews to make informed adjustments to your plan. This might involve adding new benefits, modifying existing ones, or adjusting cost-sharing arrangements.

Strategies for Controlling Costs and Improving Benefit Utilization

Controlling costs and improving benefit utilization are key aspects of effective group health benefits management. By implementing cost-containment strategies and promoting healthy behaviors, you can optimize your plan’s value for both your company and your employees.

- Promote wellness programs: Encourage employee participation in wellness programs that promote healthy habits, such as fitness activities, nutrition counseling, and stress management workshops. These programs can help reduce healthcare costs by preventing chronic conditions.

- Offer preventive care services: Cover preventive screenings and services, such as vaccinations, annual checkups, and cancer screenings. These services can identify health issues early on, leading to earlier intervention and lower treatment costs.

- Implement cost-sharing strategies: Encourage employees to take ownership of their healthcare costs by offering tiered cost-sharing options based on plan choices. This can incentivize employees to choose cost-effective options and reduce overall healthcare expenses.

- Negotiate with providers: Work with healthcare providers to negotiate favorable rates and contracts for services. This can help reduce your overall healthcare spending.

- Utilize technology: Leverage technology to streamline administrative processes, improve claims management, and provide employees with online access to their benefits information. This can help reduce administrative costs and improve efficiency.

Navigating the complex landscape of employee group health benefits requires a thoughtful approach. By understanding the diverse types of benefits, the factors that influence their design, and the legal and regulatory considerations involved, employers can create comprehensive packages that attract and retain top talent. Empowering employees with knowledge about their benefits ensures they can make informed decisions that promote their well-being and financial security.

Essential Questionnaire

What is the difference between an HMO and a PPO?

An HMO (Health Maintenance Organization) typically requires you to choose a primary care physician (PCP) within the network and obtain referrals for specialists. PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see specialists without referrals, although costs may be higher for out-of-network providers.

What is a Flexible Spending Account (FSA)?

An FSA allows you to set aside pre-tax dollars to pay for eligible medical expenses, such as deductibles, copayments, and prescription drugs. The advantage is that you save on taxes, but unused funds typically expire at the end of the year.

What are the benefits of a Health Savings Account (HSA)?

HSAs are tax-advantaged savings accounts for individuals with high-deductible health plans (HDHPs). Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. Unused funds roll over year to year.

How does the Affordable Care Act (ACA) impact employee group health benefits?

The ACA mandates that most employers with 50 or more full-time employees offer health insurance coverage to their employees. It also sets minimum standards for coverage and prohibits insurers from denying coverage based on pre-existing conditions.