Business health insurance florida taylor benefits insurance – Business Health Insurance Florida: Taylor Benefits Insurance stands as a beacon of comprehensive health coverage for businesses in the Sunshine State. Navigating the complex world of health insurance can be daunting, but Taylor Benefits Insurance provides a tailored approach, offering a diverse range of plans designed to meet the unique needs of Florida businesses. From understanding the importance of business health insurance in Florida’s competitive market to exploring the various plan options, this guide delves into the key aspects of securing optimal health coverage for your employees.

Taylor Benefits Insurance distinguishes itself through its commitment to providing exceptional customer service and support. The company understands the intricacies of Florida’s healthcare landscape and strives to simplify the process of finding the right plan. Their dedicated team of experts provides personalized guidance, helping businesses navigate the complexities of coverage options, pricing, and legal requirements.

Understanding Business Health Insurance in Florida

Florida’s business landscape is fiercely competitive, demanding that companies prioritize their employees’ well-being. Providing comprehensive health insurance is a key factor in attracting and retaining top talent, boosting employee morale, and ultimately, enhancing productivity. Business health insurance acts as a vital safety net, offering financial protection against unexpected medical expenses and ensuring access to quality healthcare.

Key Features and Benefits of Business Health Insurance Plans in Florida

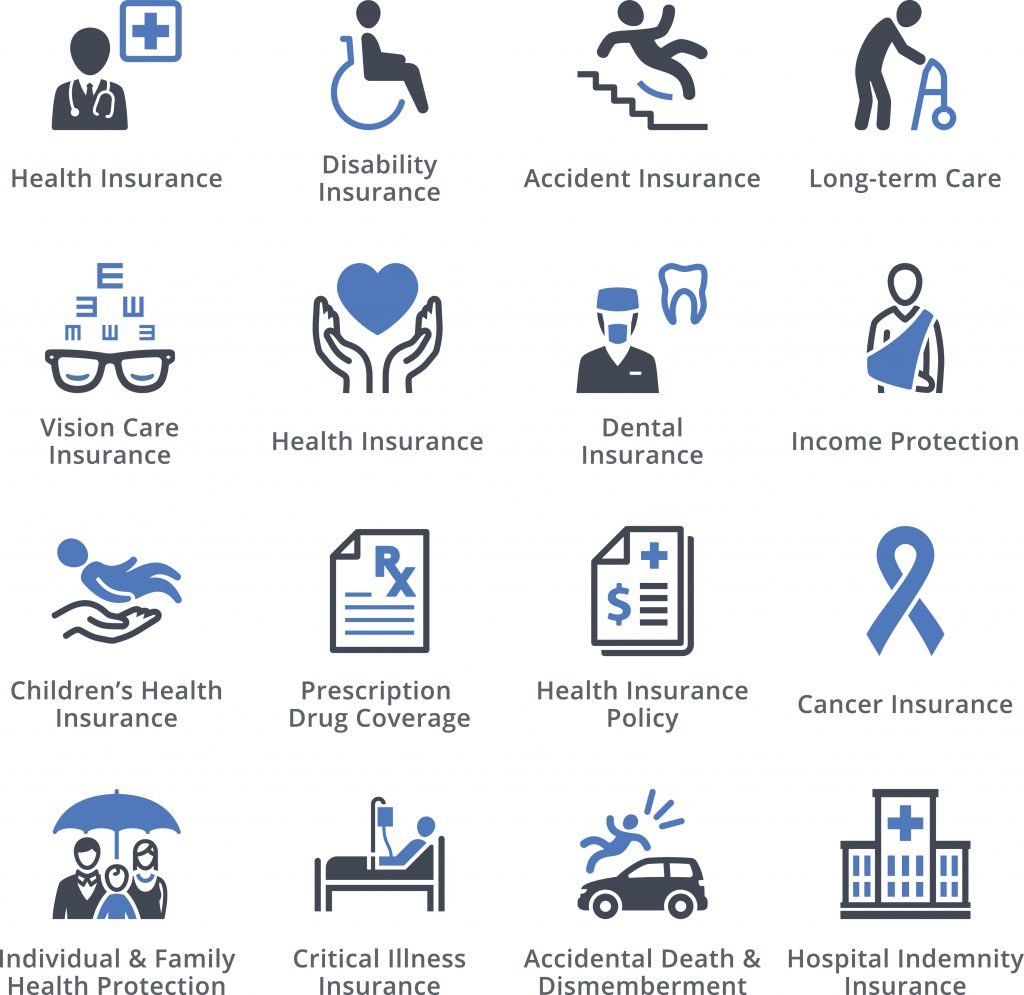

Business health insurance plans in Florida offer a range of features and benefits tailored to meet the diverse needs of businesses and their employees. These plans often include:

- Comprehensive Coverage: Business health insurance plans typically cover a wide range of medical expenses, including doctor’s visits, hospital stays, prescription drugs, and preventive care services. This comprehensive coverage provides peace of mind for employees, knowing they have access to the necessary medical care without financial strain.

- Cost-Effective Solutions: Group health insurance plans often provide more affordable rates than individual plans due to economies of scale. Businesses can negotiate favorable rates with insurance providers, benefiting from lower premiums and greater coverage.

- Flexible Plan Options: Businesses have the flexibility to choose from a variety of plan options to best suit their employees’ needs and budget. This includes various coverage levels, deductibles, and copayments, allowing businesses to customize their plans to meet their specific requirements.

- Employee Wellness Programs: Many business health insurance plans offer employee wellness programs designed to promote healthy habits and reduce healthcare costs. These programs may include health screenings, fitness classes, and smoking cessation programs, encouraging employees to take proactive steps towards their health.

Comparison of Different Types of Business Health Insurance Plans in Florida

Florida offers a variety of business health insurance plan types, each with its own unique features and benefits. Here’s a comparison of some of the most common types:

- HMO (Health Maintenance Organization): HMO plans typically provide comprehensive coverage through a network of healthcare providers. Members must choose a primary care physician (PCP) who coordinates their care. HMOs generally offer lower premiums but require pre-authorization for certain services and may have limited out-of-network coverage.

- PPO (Preferred Provider Organization): PPO plans offer greater flexibility than HMOs, allowing members to see providers both in and out of network. However, out-of-network services usually have higher copayments and deductibles. PPOs typically have higher premiums than HMOs but provide more choices for healthcare providers.

- POS (Point of Service): POS plans combine features of HMO and PPO plans. They require members to choose a PCP but allow them to see out-of-network providers with higher copayments and deductibles. POS plans offer a balance between cost and flexibility.

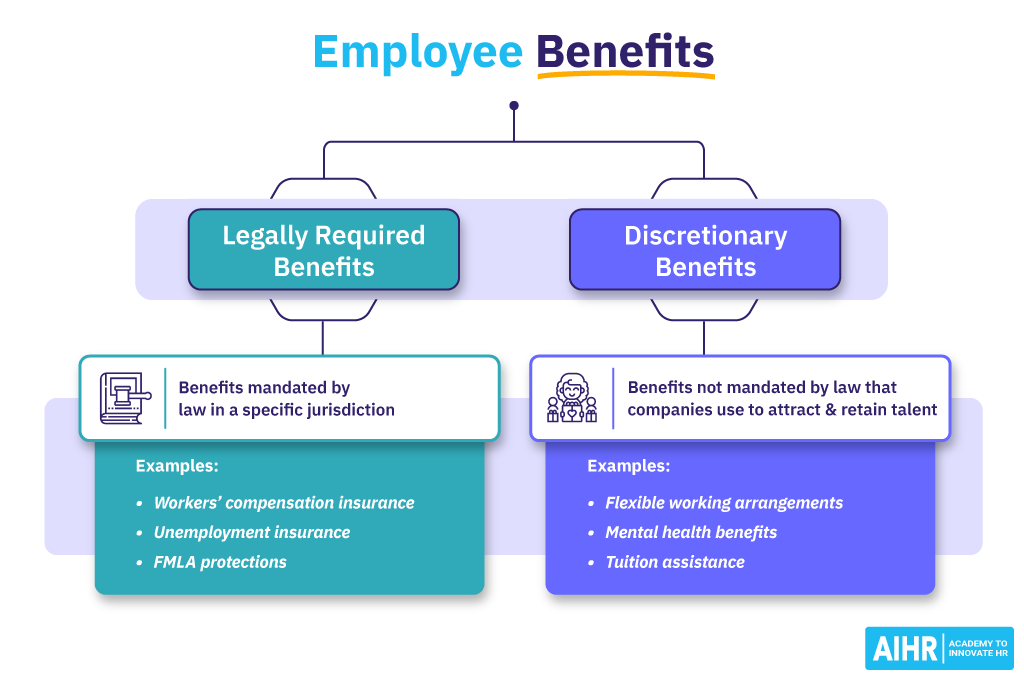

Legal Requirements and Regulations Surrounding Business Health Insurance in Florida

Florida has specific laws and regulations governing business health insurance plans. These regulations ensure fair treatment of employees and protect their access to quality healthcare. Key legal requirements include:

- Affordable Care Act (ACA): The ACA applies to businesses with 50 or more full-time employees. It mandates that these businesses offer health insurance coverage to their employees or face penalties. The ACA also includes provisions for employer-sponsored health insurance plans, including requirements for essential health benefits and coverage for pre-existing conditions.

- Florida Health Insurance Exchange: The Florida Health Insurance Exchange provides a marketplace for businesses to compare and purchase health insurance plans. It offers a variety of plan options from different insurance providers, allowing businesses to find the most suitable coverage for their needs.

- Florida Department of Insurance: The Florida Department of Insurance regulates the health insurance industry in the state. It oversees insurance providers, enforces insurance laws, and protects consumers from unfair or deceptive practices. Businesses can contact the Department of Insurance for guidance on health insurance regulations and to resolve any disputes with insurance providers.

Taylor Benefits Insurance

Taylor Benefits Insurance is a reputable and well-established provider of business health insurance in Florida. With a deep understanding of the unique needs of Florida businesses, Taylor Benefits Insurance has been serving the state’s business community for over two decades.

History and Background of Taylor Benefits Insurance

Founded in 1998, Taylor Benefits Insurance has grown into a leading provider of business health insurance solutions in Florida. The company’s commitment to providing personalized service and comprehensive coverage has earned it a strong reputation among Florida businesses. Taylor Benefits Insurance prides itself on its knowledgeable and experienced team of insurance professionals who are dedicated to helping businesses find the right health insurance plans to meet their specific needs and budgets.

Range of Business Health Insurance Plans Offered by Taylor Benefits Insurance

Taylor Benefits Insurance offers a wide range of business health insurance plans to cater to the diverse needs of Florida businesses. The company’s portfolio includes:

- Traditional Health Insurance Plans: These plans offer comprehensive coverage, including hospitalization, surgery, and physician visits, with a fixed monthly premium.

- High Deductible Health Plans (HDHPs): HDHPs offer lower monthly premiums but require a higher deductible before coverage kicks in. These plans are often paired with a Health Savings Account (HSA) to help offset medical expenses.

- Health Maintenance Organization (HMO) Plans: HMO plans provide coverage through a network of providers. Members must choose a primary care physician (PCP) who coordinates their care.

- Preferred Provider Organization (PPO) Plans: PPO plans offer greater flexibility than HMOs, allowing members to see providers outside the network, though at a higher cost.

- Self-Funded Health Plans: These plans allow businesses to take on the financial risk of covering employee healthcare costs.

Pricing and Coverage Options Available from Taylor Benefits Insurance

Taylor Benefits Insurance offers a variety of pricing and coverage options to meet the specific needs and budgets of Florida businesses.

- Premium Costs: Premium costs vary based on factors such as the size of the business, employee demographics, and the chosen plan.

- Deductibles: Deductibles are the amount an employee must pay out-of-pocket before the plan begins to cover medical expenses.

- Co-pays: Co-pays are fixed amounts that employees pay for specific medical services, such as doctor’s visits or prescription drugs.

- Co-insurance: Co-insurance is a percentage of the cost of medical services that employees share with the insurance company.

- Out-of-Pocket Maximums: Out-of-pocket maximums limit the total amount of money an employee must pay for medical expenses in a year.

Key Strengths and Unique Selling Propositions of Taylor Benefits Insurance in the Florida Market

Taylor Benefits Insurance distinguishes itself in the Florida market through its:

- Personalized Service: The company’s team of experienced insurance professionals provides personalized guidance and support to businesses throughout the insurance selection process.

- Competitive Pricing: Taylor Benefits Insurance works with a network of reputable insurance carriers to secure competitive pricing for its clients.

- Comprehensive Coverage Options: The company offers a wide range of health insurance plans to meet the unique needs of businesses in Florida.

- Strong Reputation: Taylor Benefits Insurance has earned a strong reputation for its commitment to customer satisfaction and its expertise in the Florida insurance market.

- Local Expertise: As a Florida-based provider, Taylor Benefits Insurance has a deep understanding of the state’s healthcare landscape and the specific needs of Florida businesses.

Benefits of Choosing Taylor Benefits Insurance

Choosing the right health insurance provider for your business is a crucial decision. Taylor Benefits Insurance offers a comprehensive suite of benefits designed to meet the specific needs of Florida businesses. Here, we explore the advantages of choosing Taylor Benefits Insurance and how they stand out from the competition.

Comparative Benefits

Taylor Benefits Insurance offers a variety of benefits to its clients, which are often superior to those offered by other providers. The following table compares the key features of Taylor Benefits Insurance to two of its major competitors in Florida:

| Feature | Taylor Benefits Insurance | Competitor 1 | Competitor 2 |

|---|---|---|---|

| Plan Options | Wide range of plans to suit various business sizes and budgets | Limited plan options, primarily focused on large businesses | Offers a broader range of plans but with limited customization options |

| Coverage Options | Comprehensive coverage including medical, dental, vision, and prescription drugs | Basic coverage with limited options for customization | Offers comprehensive coverage but with higher premiums |

| Customer Service | 24/7 customer support with dedicated account managers | Limited customer service hours and minimal personalized support | Offers 24/7 customer support but with long wait times |

| Claims Processing | Streamlined online claims processing with quick turnaround times | Complex claims process with lengthy turnaround times | Offers online claims processing but with limited transparency |

| Cost-Effectiveness | Competitive pricing with flexible payment options | High premiums with limited flexibility in payment options | Offers competitive pricing but with limited transparency in costs |

| Employee Wellness Programs | Offers a variety of wellness programs to promote employee health and well-being | Limited wellness programs with minimal focus on employee health | Offers comprehensive wellness programs but with limited access to resources |

Customer Service and Support

Taylor Benefits Insurance prioritizes exceptional customer service. Their team of dedicated account managers provides personalized support to businesses throughout the entire insurance journey. They offer 24/7 customer support, ensuring businesses have access to assistance whenever they need it. This commitment to customer service ensures that businesses feel valued and supported, fostering a long-term relationship built on trust and understanding.

Claims Processing Procedures and Turnaround Times

Taylor Benefits Insurance understands the importance of efficient claims processing. They have implemented a streamlined online claims process that simplifies the submission and tracking of claims. Their team is dedicated to processing claims promptly, minimizing wait times and ensuring businesses receive the necessary funds quickly. This efficient claims processing system minimizes administrative burdens and allows businesses to focus on their core operations.

Specific Programs and Initiatives

Taylor Benefits Insurance recognizes the unique challenges faced by businesses in Florida. They offer several programs and initiatives designed to support both business owners and employees. These programs include:

- Small Business Health Insurance Program: This program offers customized health insurance solutions specifically tailored to the needs of small businesses. This program provides affordable coverage options with flexible payment plans, helping small businesses manage their costs effectively.

- Employee Wellness Program: Taylor Benefits Insurance offers a comprehensive wellness program designed to promote employee health and well-being. This program includes access to fitness resources, nutrition guidance, and mental health support. By investing in employee well-being, businesses can improve employee morale, productivity, and reduce healthcare costs in the long run.

- Business Growth Support: Taylor Benefits Insurance provides resources and support to help businesses grow and thrive. This includes access to financial planning tools, legal advice, and business development resources. This comprehensive support system empowers businesses to overcome challenges and achieve their growth goals.

Factors to Consider When Choosing Business Health Insurance

Choosing the right business health insurance plan is crucial for protecting your employees’ well-being and managing your company’s healthcare costs effectively. In Florida, you have a wide array of options to consider, and making the right choice involves careful evaluation of your company’s specific needs and budget.

Factors to Consider

- Employee Demographics: Understanding the age, health status, and family size of your employees helps determine the level of coverage required. For example, a company with a younger workforce may opt for a plan with lower premiums but fewer benefits, while a company with a more senior workforce may prefer a plan with higher premiums but more comprehensive coverage.

- Budget: Your company’s budget will significantly impact the type of plan you can afford. Consider the premium costs, deductibles, copayments, and coinsurance associated with each plan. Look for plans that offer value for money and align with your company’s financial constraints.

- Coverage Options: Different plans offer varying levels of coverage, including hospitalization, surgery, prescription drugs, and preventive care. Evaluate your employees’ healthcare needs and select a plan that provides adequate coverage for the most common medical expenses.

- Network: The network of healthcare providers affiliated with a plan determines the accessibility and cost of care for your employees. Ensure that the network includes doctors, hospitals, and specialists within your geographic area.

- Flexibility: Some plans offer flexible options, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs), which can help employees save money on healthcare expenses. These options can be particularly beneficial for employees who are relatively healthy and use less healthcare.

Checklist for Business Owners

- Employee Demographics: What is the average age, health status, and family size of your employees?

- Budget: What is your company’s budget for health insurance premiums? What are your financial constraints?

- Coverage Needs: What types of medical expenses are most common for your employees? What level of coverage do you want to provide?

- Network: Do you want a plan with a wide network of providers or a narrower network with lower premiums?

- Flexibility: Are you interested in offering employees flexible spending options like HSAs or FSAs?

Negotiating the Best Rates and Coverage Options

- Compare Quotes: Get quotes from multiple insurance providers to compare rates and coverage options. Taylor Benefits Insurance can help you navigate this process and find the best plan for your needs.

- Group Discount: Inquire about group discounts available for businesses with multiple employees. Larger groups often qualify for lower premiums.

- Negotiate: Don’t be afraid to negotiate with insurance providers. Taylor Benefits Insurance can assist you in negotiating better rates and coverage options.

Understanding the Terms and Conditions

- Policy Documents: Carefully review the policy documents to understand the terms and conditions, including coverage limits, deductibles, copayments, and coinsurance. This will ensure you have a clear understanding of what is covered and what you are responsible for paying.

- Exclusions: Pay attention to any exclusions or limitations in the policy. Some plans may exclude certain services or conditions. This information is crucial for making informed decisions.

- Claims Process: Understand the claims process and how to file a claim. This information will be helpful in case of a medical emergency or when seeking reimbursement for healthcare expenses.

Resources and Support for Business Owners

At Taylor Benefits Insurance, we understand that navigating the world of business health insurance can be overwhelming. That’s why we’ve created a comprehensive suite of resources and support materials to help you make informed decisions and find the right plan for your business. We believe in providing our clients with the knowledge and tools they need to make confident choices.

Resources from Taylor Benefits Insurance

Here are some resources available from Taylor Benefits Insurance:

- Online Resources: Our website offers a wealth of information, including articles, FAQs, and guides on various aspects of business health insurance. You can also access our online quote tool to get an instant estimate for your specific needs.

- Personalized Consultations: We offer free consultations with our experienced insurance brokers who can answer your questions, explain your options, and help you find the best plan for your business.

- Educational Workshops: We regularly host educational workshops and webinars on business health insurance topics. These events provide valuable insights and practical tips to help you understand the complexities of insurance.

- Client Portal: Our secure client portal allows you to manage your insurance policies online, access your policy documents, and submit claims easily.

Government Agencies and Organizations

The following government agencies and organizations offer resources and information related to business health insurance in Florida:

- Florida Department of Insurance: This agency regulates the insurance industry in Florida and provides consumer protection resources. You can find information on insurance regulations, complaint procedures, and consumer rights on their website.

- Florida Small Business Development Centers: These centers offer a range of services to small businesses, including guidance on health insurance options. They can connect you with resources and experts who can help you navigate the insurance landscape.

- Florida Health Care Administration: This agency oversees the state’s Medicaid program and provides information on health care coverage options for low-income Floridians.

- U.S. Small Business Administration (SBA): The SBA offers resources and guidance to small businesses nationwide, including information on health insurance options and financing.

Contact Information, Business health insurance florida taylor benefits insurance

For questions or assistance, you can contact Taylor Benefits Insurance:

- Phone: (555) 555-5555

- Email: info@taylorbenefitsinsurance.com

- Website: www.taylorbenefitsinsurance.com

Securing the right business health insurance plan in Florida is a crucial step in safeguarding your employees’ well-being and ensuring the long-term success of your business. Taylor Benefits Insurance offers a comprehensive solution, combining a diverse range of plan options with exceptional customer support. By carefully considering your needs, exploring the available resources, and engaging with Taylor Benefits Insurance, you can confidently navigate the Florida health insurance landscape and secure a plan that empowers your employees and strengthens your business.

Detailed FAQs: Business Health Insurance Florida Taylor Benefits Insurance

What types of business health insurance plans does Taylor Benefits Insurance offer?

Taylor Benefits Insurance offers a variety of plans, including HMO, PPO, and POS options. They can help you determine which plan best suits your business needs and budget.

How can I contact Taylor Benefits Insurance for more information?

You can find their contact information on their website or by calling their customer service line.

What are the key factors to consider when choosing a business health insurance plan in Florida?

Key factors include the cost of premiums, the coverage options offered, the network of providers, and the overall reputation of the insurance company.

Are there any government resources available for business health insurance in Florida?

Yes, the Florida Department of Insurance offers resources and guidance on business health insurance.