Employee benefits health plans are a crucial aspect of modern workplaces, offering a safety net for employees and their families while simultaneously boosting employer morale, productivity, and retention. Understanding the various types of health plans available, from HMOs and PPOs to HSAs, is essential for both employers and employees to make informed decisions about their health and financial well-being.

This guide delves into the intricacies of employee benefits health plans, exploring the benefits for both employers and employees, cost considerations, and emerging trends in the industry. It aims to provide a comprehensive overview of the subject, empowering readers to navigate the complex world of health plans with confidence.

Understanding Employee Benefits Health Plans

Employee benefits health plans are a crucial aspect of attracting and retaining talent in today’s competitive job market. These plans offer financial protection and peace of mind to employees, allowing them to access quality healthcare without significant financial strain.

Types of Health Plans

Different health plans cater to various needs and preferences. Here’s a breakdown of common types:

- Health Maintenance Organization (HMO): HMOs offer comprehensive coverage through a network of providers. Members typically need a referral from their primary care physician to see specialists. HMOs generally have lower premiums than other plans, but may have stricter rules regarding out-of-network care.

- Preferred Provider Organization (PPO): PPOs offer flexibility in choosing providers, both within and outside the network. While out-of-network care comes with higher costs, PPOs provide more freedom and choice.

- Health Savings Account (HSA): HSAs are tax-advantaged savings accounts that allow individuals to set aside pre-tax dollars for healthcare expenses. These accounts are often paired with high-deductible health plans (HDHPs), which have lower premiums but require individuals to pay a higher deductible before insurance coverage kicks in.

- Flexible Spending Account (FSA): FSAs allow employees to set aside pre-tax dollars for eligible healthcare expenses. These accounts are often used to cover copayments, deductibles, and other out-of-pocket costs.

Factors Influencing Plan Design and Cost

Several factors influence the design and cost of employee benefits health plans. These include:

- Employee demographics: The age, health status, and location of employees can significantly impact plan costs. Younger, healthier populations tend to have lower healthcare utilization, resulting in lower premiums.

- Employer size and industry: Larger companies often have more bargaining power with insurance providers, leading to potentially lower premiums. The industry in which a company operates can also influence plan costs, as some industries have higher healthcare utilization rates than others.

- Plan design features: The specific features of a health plan, such as deductibles, copayments, and coverage limits, can significantly affect premiums. Plans with higher deductibles and copayments generally have lower premiums, but may result in higher out-of-pocket costs for employees.

- Market competition: The level of competition in the healthcare market can influence plan costs. Areas with a high concentration of insurance providers may have more competitive premiums.

Benefits for Employers: Employee Benefits Health Plan

Offering employee benefits health plans is a strategic investment for employers. It can significantly impact employee morale, productivity, and retention, ultimately contributing to a more successful and sustainable business.

Impact on Employee Morale, Productivity, and Retention

Providing comprehensive health benefits demonstrates an employer’s commitment to employee well-being, fostering a positive and supportive work environment. When employees feel valued and cared for, their morale increases, leading to greater job satisfaction and a stronger sense of loyalty to the company.

- Improved Morale: A robust health plan reduces employee stress and anxiety related to healthcare costs, leading to a more positive and engaged workforce.

- Enhanced Productivity: Healthy employees are more likely to be productive and present at work. Health plans encourage preventive care, leading to fewer sick days and improved overall health.

- Increased Retention: Competitive health benefits are a major factor in attracting and retaining top talent. Employees are more likely to stay with a company that provides comprehensive and affordable healthcare options.

Legal and Regulatory Considerations

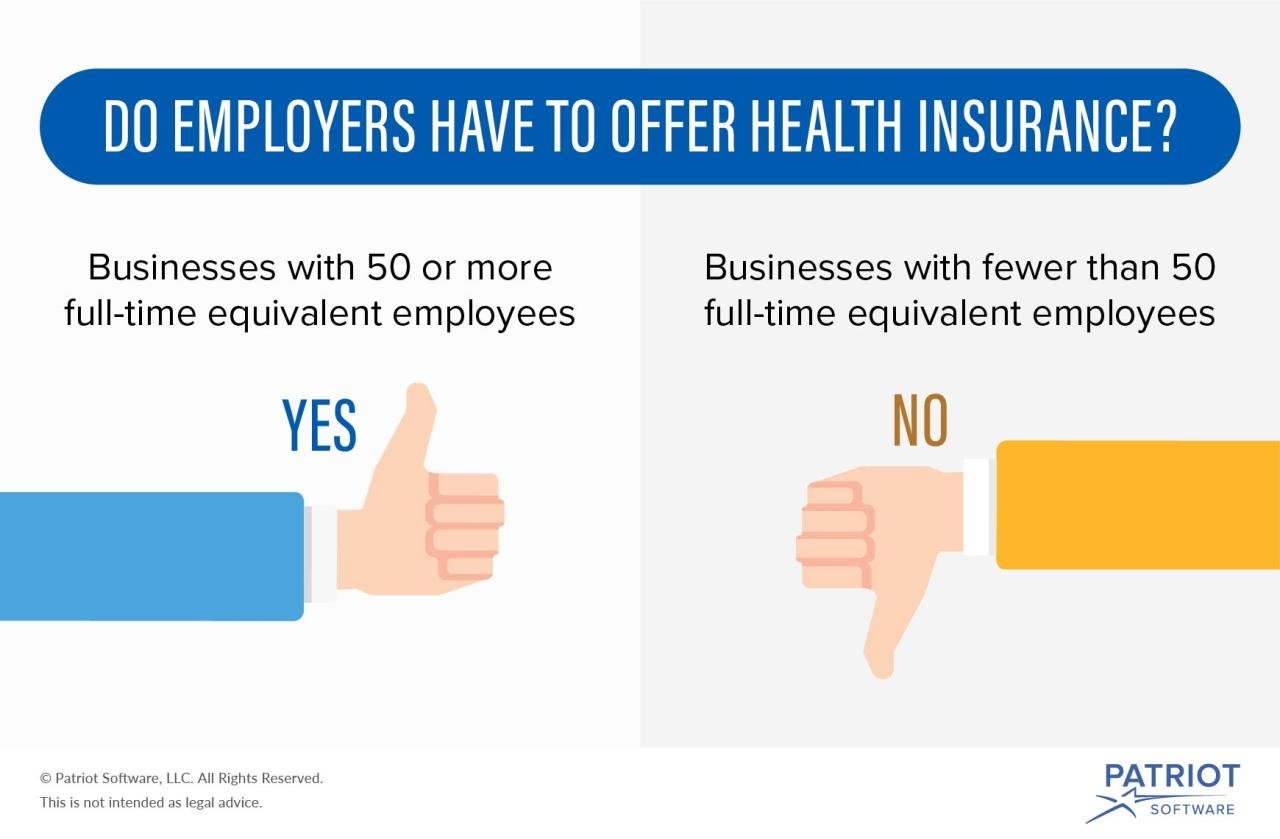

Employers offering health plans must comply with various federal and state laws and regulations. Understanding these requirements is crucial to avoid penalties and ensure compliance.

- The Affordable Care Act (ACA): Employers with 50 or more full-time equivalent employees are subject to the ACA’s employer mandate, which requires them to offer affordable health insurance or face penalties.

- The Employee Retirement Income Security Act (ERISA): ERISA governs employer-sponsored health plans, setting standards for plan administration, funding, and disclosure.

- State Laws: Many states have their own regulations regarding health insurance, including requirements for coverage and benefit mandates.

Benefits of Offering Employee Benefits Health Plans for Employers

| Benefit | Description |

|---|---|

| Improved Employee Health | Health plans encourage preventive care, leading to a healthier workforce and reduced healthcare costs in the long run. |

| Increased Productivity | Healthy employees are more productive and less likely to take sick days, contributing to higher overall output. |

| Enhanced Employee Retention | Competitive health benefits attract and retain top talent, reducing turnover costs and fostering a stable workforce. |

| Improved Employer Brand | Offering comprehensive health benefits strengthens an employer’s reputation as a responsible and caring organization, attracting and retaining talent. |

| Tax Advantages | Employer contributions to health plans are often tax-deductible, reducing the overall cost of providing benefits. |

Benefits for Employees

Employee benefits health plans offer a wide range of advantages that directly impact the well-being and financial security of employees. By providing access to comprehensive healthcare services, these plans promote a healthier workforce, enhance productivity, and contribute to overall employee satisfaction.

Financial Benefits

Participating in an employee benefits health plan can offer significant financial advantages for employees. By sharing the cost of healthcare with their employer, employees can save money on premiums and out-of-pocket expenses. This financial relief allows individuals to allocate their resources more effectively, reducing financial stress and enhancing their overall financial well-being.

- Reduced Healthcare Costs: Employee benefits health plans typically offer lower premiums and out-of-pocket expenses compared to individual health insurance plans. This cost-sharing arrangement helps employees save money on their healthcare, making it more affordable and accessible.

- Tax Advantages: Employer-sponsored health insurance premiums are often tax-deductible, reducing the overall tax burden for employees. This tax benefit further enhances the financial value of participating in a health plan.

- Preventive Care Coverage: Many employee benefits health plans cover preventive care services, such as annual checkups and screenings, at no additional cost. This encourages employees to prioritize their health and potentially prevent costly medical conditions in the future.

Impact on Well-being and Work-Life Balance

Employee benefits health plans play a crucial role in promoting employee well-being and work-life balance. By providing access to healthcare services, these plans reduce stress, improve overall health, and empower employees to prioritize their well-being.

- Reduced Stress and Anxiety: Knowing they have access to quality healthcare can significantly reduce stress and anxiety among employees. This peace of mind allows them to focus on their work and personal lives without the constant worry of unexpected medical expenses.

- Improved Health Outcomes: Regular access to preventive care and treatment services can lead to better health outcomes, reducing the risk of chronic diseases and promoting overall well-being. This translates to a healthier workforce with improved productivity and reduced absenteeism.

- Enhanced Work-Life Balance: By providing access to healthcare services, employee benefits health plans free up employees’ time and resources. They can focus on their work and personal lives without the added stress of managing healthcare costs and appointments. This contributes to a more balanced and fulfilling work-life experience.

Common Health Plan Benefits

Employee benefits health plans offer a wide range of benefits designed to meet the diverse needs of employees. Here are some common health plan benefits and their potential advantages:

- Health Insurance: Provides coverage for medical expenses, including hospitalization, surgery, doctor’s visits, and prescription drugs. This ensures employees have access to quality healthcare services without financial burden.

- Dental Insurance: Covers dental care, including checkups, cleanings, fillings, and extractions. This helps employees maintain good oral health, preventing potential health complications and reducing dental costs.

- Vision Insurance: Covers eye care, including eye exams, eyeglasses, and contact lenses. This ensures employees have access to affordable vision care, promoting healthy vision and reducing the cost of vision-related services.

- Life Insurance: Provides financial protection to beneficiaries in case of the employee’s death. This helps ensure the financial security of the employee’s family and dependents.

- Disability Insurance: Provides income replacement in case of an illness or injury that prevents the employee from working. This helps ensure financial stability during periods of disability.

- Flexible Spending Accounts (FSAs): Allow employees to set aside pre-tax income for eligible healthcare expenses. This reduces taxable income and saves employees money on out-of-pocket healthcare costs.

- Health Savings Accounts (HSAs): Offer tax-advantaged savings for healthcare expenses. These accounts allow employees to accumulate funds over time, reducing healthcare costs and promoting financial preparedness for future healthcare needs.

- Employee Assistance Programs (EAPs): Provide confidential support services for employees facing personal or work-related challenges. This includes counseling, legal assistance, and other resources to help employees cope with stress and improve their overall well-being.

Cost Considerations

Employee benefits health plans, particularly in the United States, are a significant financial undertaking for both employers and employees. Understanding the factors that influence these costs is crucial for making informed decisions and managing expenses effectively. This section explores the key cost drivers and strategies for managing health plan expenses.

Factors Influencing Health Plan Costs

The cost of employee benefits health plans is influenced by a complex interplay of factors. Employers face the challenge of balancing the need to provide competitive benefits with the need to control expenses. Employees, in turn, must navigate different plan options and cost-sharing arrangements.

- Employer Size and Industry: Larger employers often have greater negotiating power with insurance carriers, leading to lower premiums. Certain industries, like healthcare, tend to have higher health care costs due to the nature of their workforce.

- Employee Demographics: The age, health status, and geographic location of employees can significantly impact plan costs. A workforce with a higher concentration of older or less healthy individuals generally incurs higher health care expenses.

- Plan Design and Coverage: The type of health plan (e.g., HMO, PPO, HSA) and the level of coverage offered (e.g., deductibles, copayments) directly influence premiums and out-of-pocket costs for employees.

- Utilization and Claims: The frequency and cost of medical services used by employees, such as doctor visits, hospitalizations, and prescription drugs, determine the overall claims experience and impact premiums.

- Inflation and Healthcare Costs: Rising healthcare costs, driven by factors such as technological advancements and prescription drug prices, put upward pressure on premiums and out-of-pocket expenses.

Cost Variations Between Different Health Plan Types

Different types of health plans have distinct cost structures that affect both employers and employees.

| Health Plan Type | Employer Premium | Employee Premium | Out-of-Pocket Costs |

|---|---|---|---|

| Health Maintenance Organization (HMO) | Generally lower | Generally lower | Typically lower deductibles and copayments, but limited provider network |

| Preferred Provider Organization (PPO) | Generally higher | Generally higher | More flexibility in choosing providers, but higher deductibles and copayments |

| High Deductible Health Plan (HDHP) with Health Savings Account (HSA) | Lower premiums | Lower premiums, but higher deductibles | Potential for tax advantages and cost savings through HSA contributions |

Strategies for Employers to Manage Health Plan Costs

Employers can implement a variety of strategies to manage health plan costs effectively while ensuring that employees have access to quality healthcare.

- Negotiate with Insurance Carriers: Employers can leverage their size and bargaining power to negotiate lower premiums with insurance carriers. This often involves seeking competitive bids and comparing plans from different insurers.

- Promote Wellness Programs: Encouraging healthy behaviors through wellness programs can reduce healthcare utilization and claims costs. These programs might include health screenings, fitness activities, and smoking cessation support.

- Implement Cost-Sharing Mechanisms: Employers can implement cost-sharing mechanisms, such as higher deductibles or copayments, to encourage employees to be more mindful of healthcare expenses. This can be particularly effective with HDHPs and HSAs.

- Consider Tiered Networks: Offering tiered networks, where providers are grouped based on cost and quality, can help employees make more informed choices about their healthcare providers. This can lead to lower overall healthcare expenses.

- Explore Alternative Care Options: Employers can consider offering alternative care options, such as telehealth or virtual care, to provide convenient and cost-effective access to healthcare services.

Array

The landscape of employee benefits health plans is constantly evolving, driven by factors such as technological advancements, shifting healthcare needs, and a growing emphasis on employee well-being. These trends are shaping how employers design and administer their health plans, and how employees access and utilize their benefits.

The Rise of Telehealth

Telehealth, the delivery of healthcare services remotely using technology, has become increasingly popular in recent years. This trend is driven by several factors, including the convenience and accessibility of virtual care, the rising cost of traditional healthcare, and the desire for more personalized healthcare experiences.

- Increased Access to Care: Telehealth expands access to healthcare services, especially for individuals in rural or underserved areas, who may have limited access to traditional healthcare providers.

- Cost-Effectiveness: Telehealth can be a cost-effective alternative to traditional healthcare, as it eliminates the need for travel and reduces administrative costs.

- Convenience and Flexibility: Telehealth allows employees to access care from the comfort of their homes, at their convenience, and without disrupting their work schedules.

The Importance of Wellness Programs

Wellness programs are designed to promote employee health and well-being, and they are becoming increasingly common in employee benefits packages. These programs can include a variety of initiatives, such as fitness programs, nutrition counseling, stress management workshops, and smoking cessation programs.

- Improved Employee Health: Wellness programs can help employees improve their physical and mental health, leading to lower healthcare costs and improved productivity.

- Reduced Healthcare Costs: By promoting healthy habits, wellness programs can help reduce the incidence of chronic diseases, leading to lower healthcare costs for both employers and employees.

- Increased Employee Engagement: Wellness programs can help create a culture of health and well-being in the workplace, boosting employee morale and engagement.

The Growing Focus on Mental Health Benefits, Employee benefits health plan

Mental health is increasingly recognized as an important component of overall well-being. As a result, employers are expanding their mental health benefits to include services such as counseling, therapy, and medication management.

- Reduced Stigma: The increased focus on mental health benefits is helping to reduce the stigma associated with mental health issues, encouraging employees to seek help when they need it.

- Improved Employee Well-being: Mental health benefits can help employees manage stress, anxiety, and depression, leading to improved well-being and productivity.

- Reduced Absenteeism and Presenteeism: Mental health issues can lead to absenteeism and presenteeism, where employees are physically present at work but not fully productive. By addressing mental health concerns, employers can reduce these costs.

The Impact of Technology on Health Plan Administration and Access

Technology is transforming the way health plans are administered and accessed. Online portals, mobile apps, and wearable devices are making it easier for employees to manage their health benefits, access healthcare information, and track their health progress.

- Improved Efficiency: Technology is streamlining health plan administration, making it easier for employers to manage benefits and for employees to access information and services.

- Enhanced Communication: Technology is facilitating better communication between employers, employees, and healthcare providers, leading to improved coordination of care.

- Personalized Healthcare: Technology is enabling personalized healthcare experiences, with tailored recommendations and support based on individual needs and preferences.

The Role of Health Plan Design in Promoting Employee Health and Well-being

The design of health plans plays a crucial role in promoting employee health and well-being. Employers are increasingly using innovative health plan features to encourage healthy behaviors and improve the overall health of their workforce.

- Health Savings Accounts (HSAs): HSAs allow employees to save pre-tax dollars for healthcare expenses, encouraging them to be more mindful of their healthcare spending.

- High-Deductible Health Plans (HDHPs): HDHPs have lower premiums but higher deductibles, encouraging employees to choose cost-effective healthcare options.

- Wellness Incentives: Employers are offering incentives to employees who participate in wellness programs, such as discounts on health insurance premiums or fitness trackers.

Innovative Health Plan Features

Employers are constantly seeking innovative ways to improve their health plans and provide better value to their employees. Some examples of innovative health plan features gaining popularity include:

- Concierge Medicine: Concierge medicine offers personalized healthcare services with direct access to physicians, reducing wait times and improving patient satisfaction.

- Telemedicine for Mental Health: Telemedicine is being used to provide virtual mental health services, expanding access to care and reducing stigma.

- Virtual Care Navigation: Virtual care navigation services help employees find the right healthcare providers and navigate the healthcare system.

As the healthcare landscape continues to evolve, employee benefits health plans will undoubtedly play an increasingly vital role in shaping the future of work. By staying informed about the latest trends, leveraging innovative technologies, and prioritizing employee well-being, employers and employees alike can navigate the challenges and reap the rewards of a robust health plan system.

FAQ Insights

What is the difference between an HMO and a PPO?

An HMO (Health Maintenance Organization) typically requires you to choose a primary care physician (PCP) within the network. You’ll need a referral from your PCP to see specialists. PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see specialists without a referral, although you’ll generally pay a higher co-pay for out-of-network providers.

How can I choose the right health plan for me?

Consider your healthcare needs, budget, and the specific features offered by each plan. Factors to consider include deductibles, co-pays, and out-of-pocket maximums. Consult with your employer’s benefits advisor or a healthcare professional for personalized guidance.

What are some common health plan benefits for employees?

Common benefits include coverage for medical expenses, prescription drugs, dental care, vision care, and mental health services. Some plans may also offer additional benefits such as wellness programs, telehealth services, and flexible spending accounts.