Employee health benefits for small businesses are more than just a perk; they’re a strategic investment that can significantly impact employee morale, retention, and ultimately, a company’s success.

By offering competitive health benefits, small businesses can attract and retain top talent, boost productivity, and create a more engaged workforce. This guide explores the various types of health benefits available, discusses cost-effective options, and provides practical advice on managing these programs effectively.

The Importance of Employee Health Benefits for Small Businesses

In today’s competitive business landscape, attracting and retaining top talent is crucial for small businesses to thrive. Offering comprehensive employee health benefits can be a powerful tool in achieving this goal. By investing in their employees’ well-being, small businesses can foster a positive work environment, boost morale, and enhance productivity.

Impact of Employee Health Benefits on Morale and Retention

Offering health benefits demonstrates a company’s commitment to its employees’ well-being. It shows that the business values its employees and is willing to invest in their health and happiness. This can significantly impact employee morale, leading to increased job satisfaction and a sense of loyalty to the company.

- A study by the Society for Human Resource Management (SHRM) found that employees who are satisfied with their benefits are more likely to be engaged and productive.

- Offering health benefits can also reduce employee turnover. When employees feel valued and supported, they are less likely to seek employment elsewhere.

Link Between Employee Benefits and Increased Productivity

Studies have shown a strong correlation between employee benefits and increased productivity. When employees are healthy and feel secure about their well-being, they are more likely to be focused and engaged in their work.

- A 2019 study by the National Bureau of Economic Research found that employees who have access to health insurance are more productive than those who do not.

- Health benefits can also help reduce absenteeism, as employees are more likely to seek preventive care and manage health conditions effectively.

Role of Health Benefits in Attracting Top Talent

In today’s competitive job market, offering health benefits is often a key factor in attracting top talent. Many job seekers consider health benefits to be a crucial part of their compensation package.

- A survey by Glassdoor found that health insurance is the most important benefit for job seekers.

- By offering competitive health benefits, small businesses can differentiate themselves from competitors and attract highly skilled individuals.

Types of Health Benefits for Small Businesses

Providing health benefits is an excellent way to attract and retain top talent, especially in today’s competitive job market. Small businesses can offer various types of health benefits to their employees, each with its own advantages and considerations.

Medical Insurance

Medical insurance is essential for covering healthcare costs, including doctor’s visits, hospital stays, and prescription drugs. Small businesses can choose from various medical insurance plans, including:

- Health Maintenance Organizations (HMOs): HMOs typically offer lower premiums but require you to choose a primary care physician (PCP) within the network. You’ll need a referral from your PCP to see specialists.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility, allowing you to see any doctor within the network without a referral. However, they may have higher premiums.

- Point-of-Service (POS): POS plans combine features of HMOs and PPOs. They offer more flexibility than HMOs but have lower premiums than PPOs.

Dental Insurance

Dental insurance helps cover the cost of dental care, including cleanings, fillings, and extractions. It can help employees maintain good oral health and prevent costly dental procedures in the future.

Vision Insurance

Vision insurance covers the cost of eye exams, eyeglasses, and contact lenses. It can help employees maintain good vision and avoid expensive vision care costs.

Life Insurance

Life insurance provides a death benefit to beneficiaries upon the insured’s death. It can help families cover expenses such as funeral costs, debt repayment, and lost income. Small businesses can offer various types of life insurance, including:

- Term life insurance: This type of insurance provides coverage for a specific period, typically 10 to 30 years. It’s generally more affordable than permanent life insurance but doesn’t offer a cash value component.

- Permanent life insurance: This type of insurance provides coverage for life and includes a cash value component that grows over time. It’s typically more expensive than term life insurance but offers a savings element.

Flexible Spending Accounts (FSAs)

FSAs allow employees to set aside pre-tax dollars to pay for eligible healthcare expenses, such as deductibles, copayments, and prescription drugs.

Benefits of FSAs:

- Tax savings: Money contributed to an FSA is not subject to federal income tax or payroll taxes.

- Increased purchasing power: Because you’re paying for healthcare expenses with pre-tax dollars, you have more money to spend on other things.

- Flexibility: You can use FSA funds for a wide range of healthcare expenses.

Health Savings Accounts (HSAs)

HSAs are similar to FSAs but are available to individuals enrolled in high-deductible health plans (HDHPs). HSA funds can be used for eligible healthcare expenses, including deductibles, copayments, and prescription drugs.

Benefits of HSAs:

- Triple tax advantage: Contributions to an HSA are tax-deductible, earnings grow tax-free, and withdrawals for eligible medical expenses are tax-free.

- Account ownership: You own your HSA and can take it with you if you change jobs.

- Potential for long-term savings: If you don’t use your HSA funds for healthcare expenses, they can grow tax-free and be used for retirement.

Wellness Programs

Wellness programs promote employee health and well-being. They can include various initiatives, such as:

- Fitness discounts: Offering discounts on gym memberships or fitness classes can encourage employees to stay active.

- Mental health resources: Providing access to mental health professionals can help employees manage stress, anxiety, and depression.

- Health education workshops: Workshops on topics such as nutrition, stress management, and smoking cessation can help employees make healthy lifestyle choices.

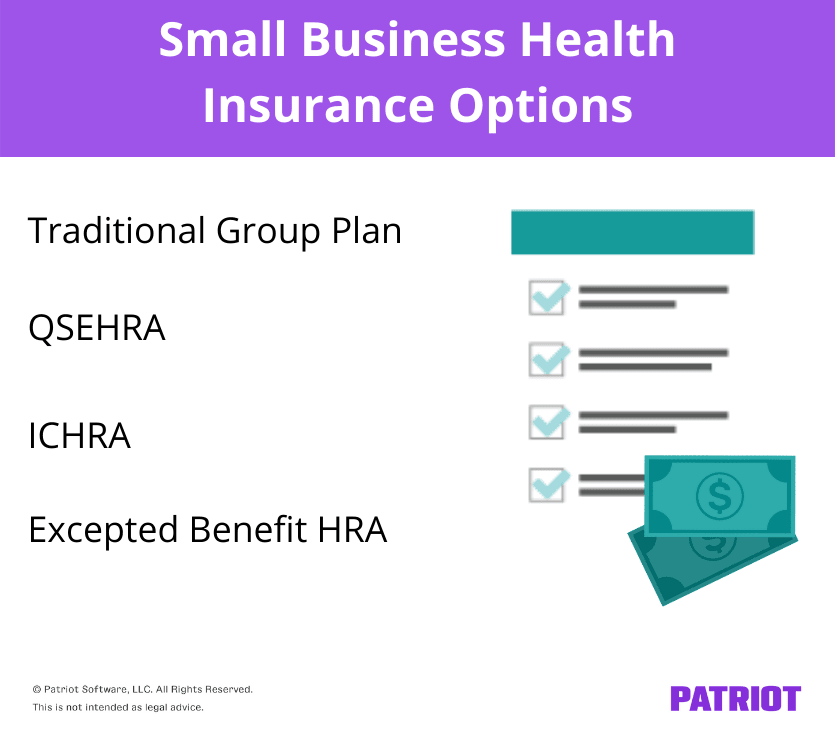

Array

Offering health insurance to employees can be a significant expense for small businesses. However, it’s an essential investment in employee well-being and can be a powerful tool for attracting and retaining talent. Fortunately, there are several affordable health insurance options available to small businesses, allowing them to provide valuable benefits without breaking the bank.

Group Health Insurance Plans

Group health insurance plans are typically offered through an employer and cover a group of employees. These plans are often more affordable than individual plans because insurance companies can spread the risk over a larger pool of people.

- Traditional Group Plans: These plans offer comprehensive coverage, including hospitalization, surgery, and outpatient care. They are typically offered through a broker or directly from an insurance company.

- Self-Funded Plans: In these plans, the employer assumes the financial risk for medical expenses, often with the help of a third-party administrator. Self-funded plans can offer greater flexibility and potentially lower premiums, but they also carry a higher level of risk for the employer.

Individual Health Insurance Plans, Employee health benefits for small businesses

Individual health insurance plans are purchased by individuals directly from an insurance company. They are often more expensive than group plans, but they offer greater flexibility in terms of coverage and plan options.

- Health Insurance Marketplace: The Affordable Care Act (ACA) created the Health Insurance Marketplace, a platform where individuals can compare and purchase health insurance plans from different insurance companies. Small businesses can use the Marketplace to find individual plans for their employees, although these plans may not be as affordable as group plans.

- Direct Purchase from Insurance Companies: Individuals can also purchase individual health insurance plans directly from insurance companies. This option can offer greater flexibility in terms of coverage and plan options, but it may require more research and comparison shopping.

Resources and Programs for Small Businesses

The government and private organizations offer resources and programs to help small businesses afford health insurance.

- Small Business Health Options Program (SHOP): SHOP is a marketplace for small businesses to compare and purchase group health insurance plans from different insurance companies. SHOP plans are often more affordable than individual plans and offer tax credits for eligible businesses.

- Tax Credits: The ACA offers tax credits to small businesses that offer health insurance to their employees. These tax credits can help offset the cost of premiums, making health insurance more affordable for small businesses.

- State and Local Programs: Many states and local governments offer programs to help small businesses afford health insurance. These programs may provide subsidies, tax breaks, or other incentives to encourage small businesses to offer health insurance to their employees.

Negotiating with Insurance Providers

Small businesses can negotiate with insurance providers to secure the best rates and coverage.

- Shop Around: Get quotes from multiple insurance providers to compare prices and coverage options.

- Consider Different Plan Options: Explore different plan options, such as high-deductible plans or plans with limited networks, to see if they can lower your premiums.

- Negotiate Premiums: Be prepared to negotiate premiums with insurance providers, especially if you have a large number of employees or a healthy workforce.

- Ask About Discounts: Inquire about discounts for healthy lifestyle programs, wellness initiatives, or other factors that can reduce your premiums.

In conclusion, employee health benefits for small businesses are a vital component of a successful and sustainable business strategy. By understanding the available options, navigating the administrative aspects, and leveraging tax advantages, small businesses can create a comprehensive benefits package that attracts and retains talent, fosters a healthy and productive workforce, and contributes to overall business growth.

FAQ: Employee Health Benefits For Small Businesses

What are the tax advantages of offering employee health benefits?

Small businesses can deduct the cost of health insurance premiums as a business expense, which reduces their taxable income. Additionally, there are tax credits available for small businesses that offer health insurance to their employees.

How can I find affordable health insurance for my small business?

Explore group plans offered by insurance brokers, consider individual plans through the Affordable Care Act marketplace, and research resources like the Small Business Health Options Program (SHOP).

What are some examples of wellness programs that I can offer?

Consider fitness discounts, mental health resources, health screenings, and educational workshops on topics like nutrition and stress management.