Health care insurance as an employee benefit is a crucial aspect of modern employment, offering a safety net for employees and their families. It provides financial security, peace of mind, and access to quality healthcare, ultimately contributing to a healthier and more productive workforce.

Beyond the immediate benefits of coverage, health insurance fosters employee loyalty and retention, as employees feel valued and supported by their employers. By offering comprehensive health plans, companies demonstrate their commitment to the well-being of their workforce, creating a positive and supportive work environment.

The Value of Health Care Insurance as an Employee Benefit

Health insurance is a valuable employee benefit that provides financial security and peace of mind. It helps employees and their families navigate the unexpected costs associated with medical care, protecting them from financial hardship.

Financial Security and Peace of Mind

Health insurance offers financial security by covering a significant portion of medical expenses. This protection is crucial for employees and their families, as unexpected medical events can lead to substantial financial burdens. With health insurance, employees can focus on their health and recovery without worrying about overwhelming medical bills.

Examples of Financial Hardship Avoidance

Consider these scenarios:

- A sudden illness or injury requiring hospitalization and surgery can result in tens of thousands of dollars in medical bills. Health insurance can cover a large portion of these costs, preventing financial ruin for the employee and their family.

- A chronic condition like diabetes or heart disease requires ongoing medical care, including medications, doctor visits, and specialized treatments. Health insurance helps manage these recurring costs, providing stability and financial peace of mind.

- Preventive care, such as routine checkups and screenings, can help detect health issues early, leading to more effective and affordable treatment. Health insurance often covers these preventive services, promoting overall health and well-being while potentially preventing more expensive treatments later.

Comparing Costs

The cost of health insurance for employees is typically significantly lower than paying for medical expenses out of pocket.

For example, the average annual premium for employer-sponsored health insurance in 2022 was $7,739 for single coverage and $22,221 for family coverage, according to the Kaiser Family Foundation.

Without health insurance, even a minor medical event could lead to thousands of dollars in out-of-pocket expenses. In contrast, health insurance provides a safety net, spreading the cost of medical care over time and reducing the financial burden on employees.

Types of Health Care Insurance Plans Offered as Employee Benefits

Your employer may offer a variety of health insurance plans to choose from, each with its own set of benefits, costs, and coverage options. Understanding the different types of plans can help you make an informed decision that best suits your individual needs and budget.

Health Maintenance Organization (HMO)

HMOs are known for their lower premiums and focus on preventive care. They typically require you to choose a primary care physician (PCP) within the network. You’ll need a referral from your PCP to see specialists or receive certain medical services.

- Benefits: Lower premiums, emphasis on preventive care, and access to a network of healthcare providers.

- Costs: Generally lower premiums than other plans. However, you may face higher out-of-pocket costs if you see a provider outside the network.

- Network Access: Limited to providers within the HMO’s network.

- Cost-Sharing Mechanisms: Typically have lower deductibles and copayments compared to other plans.

Preferred Provider Organization (PPO)

PPOs offer more flexibility than HMOs, allowing you to see any provider in or out of the network. However, you’ll pay less if you stay within the network.

- Benefits: Greater flexibility in choosing providers, including out-of-network options.

- Costs: Generally higher premiums than HMOs but lower out-of-pocket costs for in-network care.

- Network Access: Wider network of providers, including out-of-network options.

- Cost-Sharing Mechanisms: Typically have higher deductibles and copayments than HMOs, but lower out-of-pocket costs for in-network care.

Point of Service (POS)

POS plans combine features of both HMOs and PPOs. You can choose to see providers within or outside the network, but you’ll typically pay more for out-of-network care.

- Benefits: Flexibility in choosing providers, with the option to see out-of-network providers.

- Costs: Premiums are typically between HMOs and PPOs, with higher out-of-pocket costs for out-of-network care.

- Network Access: Similar to HMOs, with the option to see out-of-network providers at a higher cost.

- Cost-Sharing Mechanisms: Cost-sharing mechanisms vary depending on whether you see in-network or out-of-network providers.

Health Savings Account (HSA)

HSAs are coupled with high-deductible health plans (HDHPs). They allow you to contribute pre-tax dollars to a dedicated account that can be used for medical expenses.

- Benefits: Tax advantages for contributions and withdrawals for qualified medical expenses, potential for lower premiums with HDHPs, and the ability to roll over unused funds year to year.

- Costs: Higher deductibles than other plans, but potential for lower premiums.

- Network Access: Network access depends on the HDHP you choose.

- Cost-Sharing Mechanisms: High deductibles, but you can use HSA funds to pay for eligible medical expenses.

Flexible Spending Account (FSA)

FSAs are employer-sponsored accounts that allow you to set aside pre-tax dollars to pay for eligible medical expenses.

- Benefits: Tax advantages for contributions and withdrawals for qualified medical expenses.

- Costs: Lower premiums than some other plans, but any unused funds at the end of the year are typically forfeited.

- Network Access: Network access depends on the health plan you choose.

- Cost-Sharing Mechanisms: May help reduce out-of-pocket costs for medical expenses.

Comparing Key Characteristics of Different Plan Types, Health care insurance as an employee benefit

| Plan Type | Premiums | Deductibles | Copayments | Network Access |

|---|---|---|---|---|

| HMO | Low | Low | Low | Limited |

| PPO | High | High | High | Wide |

| POS | Moderate | Moderate | Moderate | Moderate |

| HSA (with HDHP) | Low | High | High | Depends on HDHP |

| FSA | Lower | Variable | Variable | Depends on health plan |

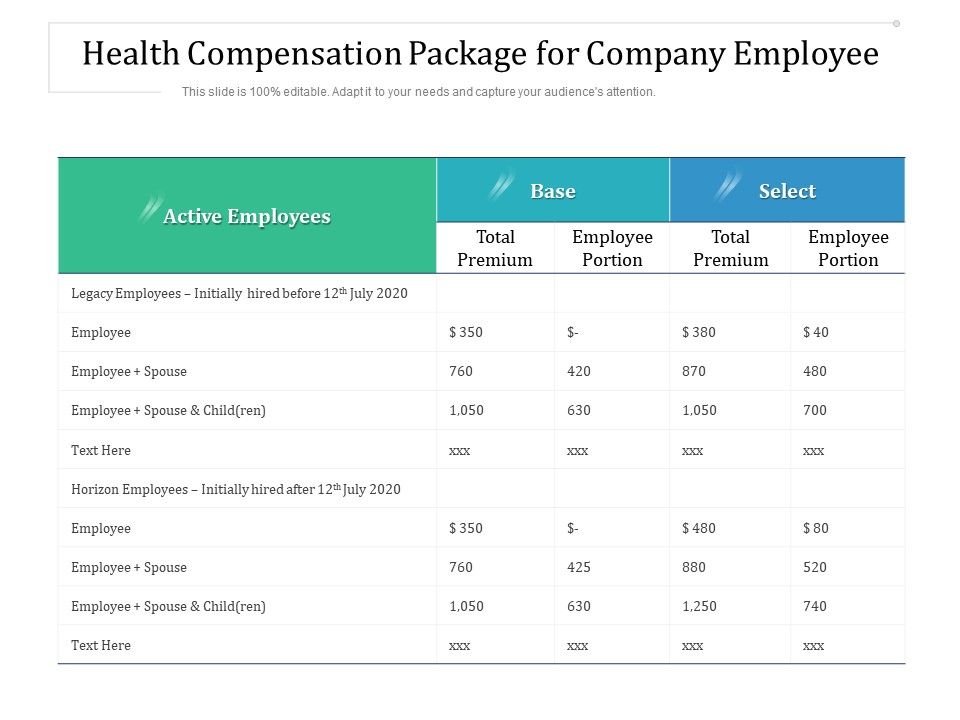

Employer Contributions and Employee Costs

Offering health insurance as an employee benefit is a significant investment for employers. It demonstrates their commitment to employee well-being and can be a powerful tool for attracting and retaining talent. However, the cost of health insurance is shared between employers and employees, with employers typically making substantial contributions.

Employer Contributions

Employers contribute to the cost of health insurance for their employees in various ways. These contributions can be substantial, often covering a significant portion of the total premium cost. This shared responsibility reflects the mutual benefit of health insurance for both employers and employees.

Methods for Sharing Costs

There are various methods for sharing the cost of health insurance between employers and employees. These methods often involve a combination of fixed dollar amounts, percentage contributions, and employee cost-sharing mechanisms.

- Fixed Dollar Amount: Employers may contribute a fixed dollar amount towards each employee’s health insurance premium. This amount can be a flat rate for all employees or vary based on factors like age, family size, or plan type.

- Percentage of Premium: Employers may contribute a percentage of the total premium cost. This percentage can be applied to the entire premium or only to the portion covering the employee’s coverage, with employees responsible for the remaining share.

- Employee Cost-Sharing: Employees often share in the cost of health insurance through deductibles, copayments, and coinsurance. These cost-sharing mechanisms help to manage healthcare expenses and encourage employees to make informed decisions about their healthcare utilization.

Factors Influencing Employee Costs

The cost of health insurance premiums for employees can be influenced by several factors. These factors can vary significantly based on the employer’s industry, location, and the specific health insurance plan offered.

- Plan Type: The type of health insurance plan chosen, such as a Health Maintenance Organization (HMO) or a Preferred Provider Organization (PPO), can significantly impact premium costs. HMOs typically have lower premiums but may have more limited provider networks, while PPOs offer more flexibility but often come with higher premiums.

- Coverage Levels: The level of coverage chosen, such as individual or family coverage, will influence the premium cost. Family coverage naturally costs more than individual coverage due to the inclusion of dependents.

- Employee Demographics: Factors such as age, location, and health status can influence premium costs. For example, older employees generally have higher healthcare expenses and may face higher premiums.

- Employer Contributions: The level of employer contributions directly impacts the amount employees pay for their health insurance. Higher employer contributions result in lower employee costs.

The Impact of Health Care Insurance on Employee Productivity and Retention: Health Care Insurance As An Employee Benefit

Offering health insurance as an employee benefit can have a significant impact on employee productivity and retention, ultimately benefiting both employees and employers. Access to comprehensive health insurance helps employees feel secure and supported, leading to improved well-being and overall job satisfaction.

Improved Employee Health and Well-Being

When employees have access to quality health insurance, they are more likely to seek preventive care and address health concerns early on. This proactive approach to health management can help prevent minor issues from escalating into major health problems, leading to fewer sick days and reduced healthcare costs in the long run.

The Link Between Health Insurance and Productivity

A healthy workforce is a productive workforce. Studies have shown a strong correlation between employee health and productivity. When employees feel healthy and well-supported, they are more likely to be engaged, focused, and motivated at work. This translates to higher productivity, improved quality of work, and reduced absenteeism.

Health Insurance and Employee Retention Rates

Research consistently shows that offering comprehensive health insurance benefits is a significant factor in attracting and retaining top talent. Employees value health insurance as a critical component of their overall compensation package. When employers invest in their employees’ well-being by providing quality health coverage, it signals a commitment to their employees’ long-term success, fostering loyalty and reducing turnover.

Competitive Advantage

In today’s competitive job market, offering comprehensive health insurance benefits can give employers a significant competitive advantage. Attracting and retaining skilled and experienced employees is essential for business success, and health insurance is often a key factor in employee decision-making. Employers who prioritize employee well-being by offering strong health benefits demonstrate their commitment to their workforce, making them a more desirable place to work.

Array

The landscape of employee health care benefits is constantly evolving, driven by factors such as changing demographics, technological advancements, and a growing focus on employee well-being. Employers are increasingly recognizing the importance of offering comprehensive and innovative benefits packages to attract and retain top talent. This section explores some of the key emerging trends shaping the future of employee health care benefits.

Mental Health Benefits

Mental health is becoming increasingly recognized as an integral part of overall well-being. Employers are responding to this growing awareness by expanding their mental health benefits to provide employees with greater access to support and resources.

- Increased Coverage for Mental Health Services: Many employers are expanding coverage for mental health services, including therapy, counseling, and medication, to ensure that employees have access to the care they need.

- Employee Assistance Programs (EAPs): EAPs provide confidential support services for employees facing personal or work-related challenges, including mental health issues. These programs often offer a range of services, such as counseling, crisis intervention, and legal and financial advice.

- Mental Health Awareness and Training: Employers are also investing in mental health awareness training for managers and employees to reduce stigma and promote a more supportive workplace culture.

Telehealth and Virtual Care

Telehealth and virtual care options are gaining significant traction as employers seek to provide convenient and accessible health care services to their employees.

- Virtual Doctor Visits: Telehealth platforms allow employees to consult with doctors remotely via video or phone calls, eliminating the need for in-person appointments. This is particularly beneficial for employees with busy schedules or who live in remote areas.

- Remote Monitoring and Management: Virtual care solutions can also be used for remote monitoring and management of chronic conditions, allowing employees to receive ongoing care and support without having to travel to a doctor’s office.

- Mental Health Apps: There are numerous mental health apps available that offer self-guided therapy, meditation, and other tools to support mental well-being.

Wellness Programs and Preventative Care

Employers are increasingly recognizing the value of investing in wellness programs and preventative care services to promote employee health and reduce healthcare costs.

- Health and Wellness Incentives: Many employers offer incentives, such as discounts on health insurance premiums or fitness trackers, to encourage employees to adopt healthy habits.

- On-site Wellness Programs: Some employers offer on-site wellness programs, such as fitness centers, healthy food options, and health screenings, to promote a healthy workplace culture.

- Preventative Care Coverage: Employers are expanding coverage for preventative care services, such as vaccinations, screenings, and wellness check-ups, to help employees stay healthy and prevent chronic diseases.

Innovative Health Care Benefits

Employers are constantly seeking new and innovative ways to attract and retain top talent.

- Concierge Medicine: Concierge medicine programs offer personalized healthcare services, including direct access to physicians, shorter wait times, and comprehensive care coordination.

- Fertility Benefits: As more employees face challenges with infertility, employers are expanding fertility benefits to cover a wider range of treatments and support services.

- Caregiving Support: Employers are increasingly recognizing the need to support employees who are caregivers for family members. This can include benefits such as eldercare assistance, childcare subsidies, and flexible work arrangements.

In conclusion, health care insurance as an employee benefit is a strategic investment for both employers and employees. It promotes financial security, improves employee well-being, and enhances productivity. As healthcare costs continue to rise, the value of comprehensive health insurance plans will only grow, making it an essential component of a competitive compensation package.

FAQs

What are the main types of health insurance plans offered as employee benefits?

Common types include HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), POS (Point of Service), HSA (Health Savings Account), and FSA (Flexible Spending Account). Each plan has unique features regarding coverage, costs, and network access.

How do employers contribute to the cost of health insurance?

Employers typically contribute a significant portion of the premium costs, with employees paying the remaining balance. The contribution model can vary, with some employers offering a fixed dollar amount while others contribute a percentage of the premium.

What are the factors that influence the cost of health insurance premiums?

Factors such as the employee’s age, location, family size, and the chosen plan type all contribute to the cost of health insurance premiums. Employers also consider the overall health of their workforce when negotiating premiums with insurance providers.

Are there any emerging trends in employee health care benefits?

Yes, there is a growing focus on mental health benefits, telehealth options, and wellness programs. Employers are increasingly recognizing the importance of supporting the holistic well-being of their employees, offering innovative benefits to attract and retain top talent.